Summary

On 12/6/2025, SIPS was enhanced to introduce the calculation and display of the Enhanced Senior Deduction (from the One Big Beautiful Bill (OBBB) Act) for the 2025–2028 tax years within SIPS scenarios that have the Advanced Tax Feature enabled.

SIPS Implementation Summary

- Structured Income Plan

- All plans with the automatic tax calculation enabled are now updated with this new logic for any tax calculations in 2025 and beyond.

- Cashflow and Tax Advisor

- Scenarios in the Cashflow and Tax Advisor created before this release will not be affected. These scenarios will include a “TCJA” in the tax-year.

- Scenarios in the Cashflow and Tax Advisor created after this release for 2025 and later will be labeled as OBBB tax scenarios and use the new 2025 Form 1040 structure.

- The calculated deduction is displayed in a new Row 13b on the Cashflow and Tax Advisor Screen (users with Advanced Tax can override this amount).

- The "Print 1040" function will use the new 2025 OBBB Form 1040 for these new scenarios.

Detailed Changes:

IRS Rules Summary

- The client must be 65 or older in the applicable tax year

- The deduction amount has an income limit of $75,000 for single or $150,000 for joint filers based upon their Modified Adjusted Gross Income (MAGI).

- The deduction amount is reduced or eliminated if MAGI exceeds certain thresholds:

Filing Status | Phase Out Starts at MAGI over | Fully Phased Out at MAGI over |

Single | $75,000 | $175,000 |

Joint | $150,000 | $250,000 |

- The deduction can be claimed whether the filer takes the standard deduction or itemizes their deductions.

- The base amount for the enhanced senior deduction is $6,000 per qualifying individual:

- Single: up to $6,000

- Joint: Up to $12,000 total if both spouses qualify (each gets up to $6,000)

SIPS Implementation

SIPS rules for client eligibility are based upon the IRS guidance and draft 2025 Form 1040 documents (links below), including a new 1040 Schedule 1-A which provides the specific rules for the calculation of the deduction amount. SIPS follows the below steps to calculate the deduction amount (for cases with Advanced Tax enabled):

- Determine Age Eligibility by Tax Year

- For the year 2025, must be born before January 2, 1961

- For the year 2026, must be born before January 2, 1962

- For the year 2027, must be born before January 2, 1963

- For the year 2028, must be born before January 2, 1964

- Determine Income Eligibility

- SIPS uses the Income Total field from the Cashflow and Tax Advisor Screen as the Modified Adjusted Gross Income (MAGI).

- Next SIPS determines the “MAGI Threshold:”

- If the client is single use 75,000

- if the client is married use 150,000

- Next SIPS subtracts the “MAGI Threshold” from the income total amount

- If the difference is zero or less

- Each client who meets the age eligibility for this year will receive the full $6,000 deduction

- The amount will apply to one or both clients, depending on their age eligibility.

- If the difference is greater than zero

- Multiply the difference by 6%, this result is the “income factor”

- Subtract the “income factor” from 6,000

- if the difference is greater than zero, this is the amount of the senior deduction for each client

- If the difference is less than zero, the client does not meet income eligibility, and 0 will be displayed as the deduction amount

- If the difference is zero or less

- Example (Single Client): The MAGI threshold is $75,000. If Total Income is $100,000, the “income factor” is $25,000. Therefore, the deduction is $4,500 calculated as the income factor ($25,000 × 6% = $1,500), subtracted from the full deduction amount ($6,000 - $1,500).

- Example (Joint Clients both spouses eligible): The MAGI threshold is $150,000. If Total Income is $220,000, the “income factor” is $70,000. Therefore, the deduction is $7,800 calculated as the income factor ($70,000 × 6% = $4,200), subtracted from the full deduction amount ($12,000 - $4,200).

- July IRS Press Release: https://www.irs.gov/newsroom/irs-releases-tax-inflation-adjustments-for-tax-year-2026-including-amendments-from-the-one-big-beautiful-bill

- October IRS Press Release: https://www.irs.gov/newsroom/one-big-beautiful-bill-act-tax-deductions-for-working-americans-and-seniors

Changes to the Structured Income Planning Screen

All scenarios with the Advanced Tax Feature enabled will have the enhanced senior deduction automatically calculated and displayed in the Approximate Income Tax column for the tax years 2025 – 2028.

Changes to the Cashflow and Tax Advisor Screen

There are three changes to this screen:

- Labeling Tax Code

- New rows added to OBBB tax scenarios to align with 2025 form 1040

- New 2025 Form 1040 and Printing Previously Created Scenarios

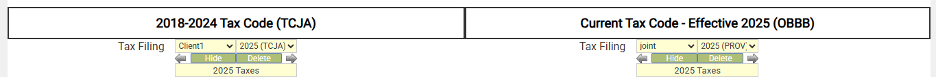

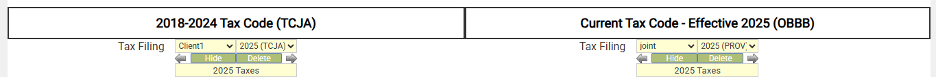

Tax Code Labels

- Above the tax scenarios a new label now appears to illustrate which code was used to calculate the tax scenario.

- All scenarios created prior to the enhanced senior deduction enhancement release will not be changed – they will appear under the TCJA heading – and will not have the new deduction included.

- All new tax scenarios created for 2025 and forward will appear under the OBBB heading and will automatically include the enhanced senior deduction calculation.

New rows added to OBBB tax scenarios to align with 2025 form 1040

- New tax scenarios created for 2025 (and all future years) will now use the new 2025 Form 1040

- Tax scenarios now display rows 13a, 13b, and 14 to match the 2025 Form 1040

- Row 13a – no changes to functionality – just new label

- Row 13b – this is where the calculated enhanced senior deduction amount will appear.

- SIPS will calculate the amount automatically when creating the scenario (if the user has advanced tax enabled)

- Users can use the overrides column to adjust the amount (and then click the calculate button)

- Row 14 – this is the total of rows 12, 13a, and 13b

New Form 1040 and Printing Previously Created Scenarios

- Clicking the “Print 1040” button under OBBB tax scenarios will stamp the new 2025 Form 1040 (and Schedule 1 if applicable) with relevant data from the tax scenario.

- The new form reflects the senior deduction and has lines 13a, 13b, and 14, which match the Cashflow and Tax Advisor Screen

- Clicking Print 1040 for previous years or tax scenarios created prior to the enhanced senior deduction release will use the 1040 from the applicable year or the 2025 Form 1040 prior to the passage of the OBBB. This Form 1040 will be labeled as TCJA

- Examples of 1040 form printing

Tax Year | Tax Code | Form 1040 Version |

2021 | TCJA (OBBB not possible) | 2021 |

2024 | TCJA (OBBB not possible) | 2024 |

2025 | TCJA | 2025 TCJA |

2036 | TCJA | 2025 TCJA |

2025 | OBBB | 2025 OBBB |

2027 | OBBB | 2025 OBBB |

Links to Updated Form 1040 from the IRS

- Draft 2025 1040 form: https://www.irs.gov/pub/irs-dft/f1040--dft.pdf

- Draft 2025 1040 Schedule 1-A form: https://www.irs.gov/pub/irs-dft/f1040s1a--dft.pdf

- SIPS will be updated in early 2025 with the final Form 1040 versions once published by the IRS